When it’s time to refix your home loan, TSB makes it easy. Whether you're using online banking or the TSB mobile app, you can lock in a new fixed rate in just a few clicks.

Before you refix

It's important you consider your situation before you choose to refix. If you decide to break your fixed term after you refix, you may be charged an early repayment fee. If you’re thinking about selling your property or looking to make lump sum repayments, have a chat with one of our lending specialists about your options first.

How to refix your home loan

- Log in to online banking or the TSB mobile app

- Look for a notification

You’ll see a refix notification on your dashboard 40 days before your current term ends.1 - Review your options

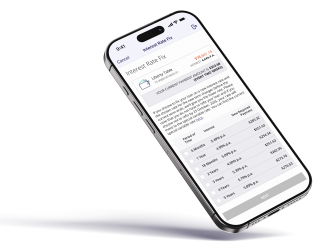

Compare our available rates, terms and repayment amounts. - Choose your new fixed term

If your rate is increasing, your repayments may also need to increase to repay your home loan within your loan term. - Confirm your selection—and you’re done

Your new rate will take effect as soon as your current term ends. If the rate decreases before your new term starts, you'll automatically get the lower of these two rates.

Keep in mind if you don’t refix your interest rate, you'll automatically move to the current variable rate at the end of the fixed rate term.

Prefer to talk it through?

We're here to help. When your loan is coming up for renewal, you can give one of our lending specialists a call to talk through your options. They're available Monday to Friday, 8:30am–5pm.

Important information

- There are currently some exceptions to re-fixing your loan through online banking or the TSB app. Please contact us if you can't re-fix through online banking or the app.

General Lending Terms and Conditions:

- TSB may approve residential loans with less than a 20% deposit subject to bank funding requirements.

- An early repayment fee may apply on fixed rate loans.

- All interest rates are subject to change.

- Lending criteria, terms and conditions and fees apply.

- When you bank with TSB you agree to our General Terms.