From our humble roots in Ngāmotu New Plymouth, we’ve grown into a nationwide bank with a difference. Owned by Toi Foundation, our profits support communities across Aotearoa. Join us on the journey.

Celebrating 175 years

We’ve come a long way together

TSB first opened in 1850, and since then we’ve grown together, weathering wars, recessions, and countless crimes against fashion.

We’ve consistently stayed Kiwi-owned, refusing to sell out. 175 years on, we’re stronger, wiser and ready to start the next chapter with you.

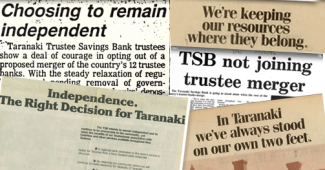

Independence you can rely on

When the government proposed a merger of all 12 independent New Zealand banks back in 1985, we knew it wouldn’t be in the best interests of our customers.

The pressure to merge was intense from the other banks and the government. But we stood firm. The merger went ahead without us. But within a few years it faltered and was sold off to an Aussie bank.

So how did it work out for us?

We grew stronger, expanding our organisation to support Kiwi and businesses right across the motu, with banking products, digital services and our famous personalised care.

Along the way, we’ve been recognised for our customer service and products, and putting you first is just as important as it's always been.

Giving back

TSB is owned by philanthropic organisation Toi Foundation, this is a unique part of who we are and makes us different from other banks in Aotearoa.

Since 1988, TSB dividends coupled with the mahi of our friends at Fisher Funds Management Ltd, have helped Toi Foundation invest more than $250m into the community.

The more people and businesses that bank with us, the greater impact Toi Foundation can have.

From our Board to our frontline, this is why our people choose to work for TSB, and it means our customers and community are genuinely central to everything we do.

It all began in Ngāmotu New Plymouth

Our journey, key moments and milestones

1850

Foundation of the Bank

New Plymouth Savings Bank was established

1920

First branch opens

The bank opened our first physical branch in Fitzroy, New Plymouth

1964

A new name

As we expanded throughout the region, we were renamed Taranaki Savings Bank

1975

Banking innovation

Became the first bank to offer free, interest-bearing cheque accounts

1981

ATM pioneer

First bank to develop ATMs, enabling customers to access their money 24/7

1986

Standing strong

While other trustee banks merged, we chose to remain independent & 100% New Zealand owned

1988

Community ownership

TSB Community Trust was established as the bank’s shareholder, ensuring profits would benefit communities

1989

Corporate evolution

Taranaki Savings Bank was renamed TSB Bank

2010

Celebrating legacy

The TSB Museum was opened and a book commemorating the bank’s rich heritage ‘Faith to Fortune’ was published

2001–2016

National expansion

Our reach was extended beyond Taranaki and across New Zealand

2017

Modern identity

Rebranded simply as TSB, reflecting our modern, nationwide presence while staying true to our heritage