Whether you’re focused on keeping costs low or enjoying premium benefits, we have a credit card to match. Explore our Low Rate and Platinum Mastercards to see which suits you best.

Our credit card options

Low Rate Mastercard

11.95% p.a.

Interest rate for purchases and cash advances.

- Our lowest rate credit card

- Up to 55 days interest free

- $500 minimum credit limit

- Mobile Phone Protection Insurance

- Price Protection Insurance

- Purchase Protection Insurance

$20 annual card fee. Other fees and interest rates apply. Interest rates are subject to change.

TSB Platinum Mastercard

20.95% p.a.

Interest rate for purchases and cash advances.

- Cashback rewards

- Up to 55 days interest free

- $8,000 minimum credit limit

- Mobile Phone Protection Insurance

- Price Protection Insurance

- Purchase Protection Insurance

- Travel Insurance

$90 annual card fee. Other fees and interest rates apply. Interest rates are subject to change.

Features & benefits

Up to 55 days interest free

You’ll get up to 55 days interest free credit for purchases when you pay the closing balance of your statement in full each month by the due date. Purchases don’t include cash advances or balance transfers.

Tap to pay with Apple or Google Pay

Apple Pay is an easy, secure and private way to pay - in-store, online and even in your favourite apps. Available with any TSB Mastercard on your iPhone, Apple Watch, iPad and Mac.

Google Pay brings together everything you need at checkout and protects your payment info with multiple layers of security to help keep your account safe. Pay on websites, in apps, and in stores, with any TSB Mastercard and Android device.

Mastercard Zero liability

As a cardholder, you won’t be held responsible for unauthorised transactions if:

- You've used reasonable care in protecting your card from loss or theft; and.

- You promptly reported loss or theft to your financial institution.

Mastercard cardholder offers and experiences

As a cardholder you’ll get access to special deals, premium experiences and discounts across travel, dining, entertainment, shopping and more. These offers are curated by Mastercard and available to anyone with an eligible Mastercard, including debit and credit cards. For full details visit Mastercard priceless™

Braille for easy identification

To help our vision impaired customers identify which card they’re using, our debit and credit cards have ‘TSB D’, ‘TSB L’ or ‘TSB P’ printed in braille on them.

Our debit and credit cards have a vertical design, so the braille is printed on the lower left side, to help customers identify the orientation of their card for tapping or inserting the chip.

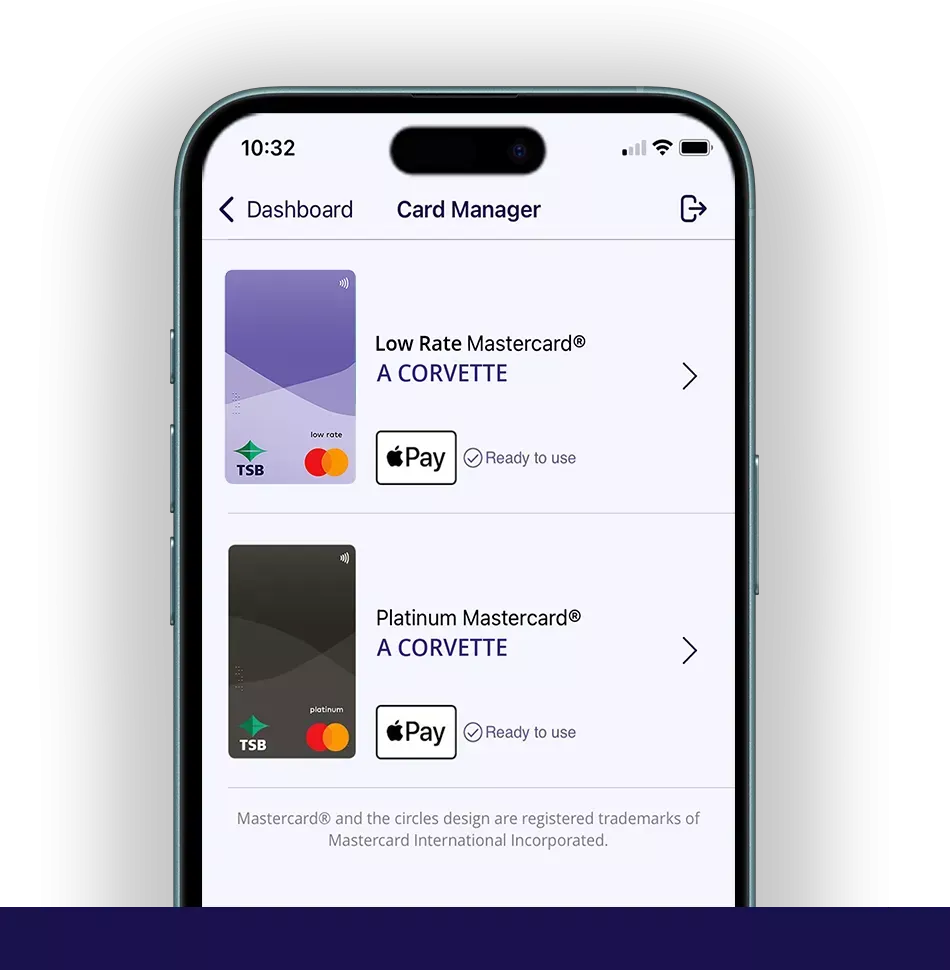

Managing your card

Manage your card with online banking and the TSB mobile app.

With online banking and the TSB mobile app you can make payments, keep track of your spending and check your balances, all from your mobile, tablet or desktop. You can also use the Card Manager tool to set a PIN, block/unblock/cancel your card and order a replacement.

Get help with your card

Has something gone wrong with your card? Learn how to block a misplaced card, report it as lost or stolen, and dispute a transaction.

Apply online for a credit card

The application will take approximately 15-20 minutes to complete.

To apply for a TSB credit card, you need to make sure you:

- Are aged 18 years or over.

- Receive a regular income of $18,000 or more per year (after tax).

- Are either a New Zealand citizen living in New Zealand, or resident visa holder living in New Zealand.

- Are not bankrupt and have not had any insolvency action taken against you.

- Can meet our lending criteria and have a good credit history.

- Have your bank statements, information on all your expenses and proof of your income handy.

We’ll handle all information you provide us in accordance with our Privacy Notice and the Privacy Act 2020.

Looking for a credit card alternative?

You may be interested in

Important information

- The TSB Apple Pay Conditions of Use apply when you use your card in Apple Pay.

- The TSB Google Pay Conditions of Use apply to Google Pay, see Google Pay for more information.

- For details on Mastercard’s Zero Liability promise visit mastercard.co.nz/zeroliability.

- Priceless experiences are subject to terms and conditions at www.priceless.com/terms/en_NZ

- Different interest rates apply to balance transfers. We can change our interest rates and fees from time to time.

- Mobile Phone Protection Insurance, Purchase Protection Insurance and Price Protection Insurance are underwritten by AIG Insurance New Zealand Limited (“AIG”). AIG, TSB or Mastercard do not provide financial advice about the insurance. TSB Credit Mastercard Insurance Terms and Conditions sets out the details of what is covered, claims limits, what is not covered, and eligibility to help you determine if the insurance is right for you. The Insurance (Prudential Supervision) Act 2010 requires licensed insurers to have a current financial strength rating that is given by an approved rating agency. AIG Insurance New Zealand Limited has an A+ (Strong) insurer financial strength rating given by Standard & Poor’s (Australia) Pty Ltd. The rating scale, in summary form is:

AAA Extremely Strong BBB Good CCC Very Weak SD Selective Default

AA Very Strong BB Marginal CC Extremely weak D Default

A Strong B Weak C Regulatory Action NR Not Rated

The rating from 'AA' to 'CCC' may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the major rating categories. A full description of the rating scale is available on Standard & Poor’s website. - Eligible purchases exclude fees, interest, cash advances, transactions that are like cash (such as purchases of travellers’ cheques and crypto currency), balance transfers, gambling chips and other gambling transactions (such as online gambling), tax payments and other payments to a tax department in New Zealand or overseas, any transaction that is reversed or refunded, and transactions that are processed on an account or card that is not a TSB Platinum Mastercard.

- TSB Platinum Mastercard Travel Insurance is issued and managed by AWP Services New Zealand Limited trading as Allianz Partners (NZBN 9429035270157) under binder with and on behalf of Mitsui Sumitomo Insurance Company, Limited (NZBN 9429039809810, FSP Number 20661) (Incorporated in Japan) as the underwriter. You should read the Policy Wording and consider obtaining independent legal or financial advice before making any decisions about this insurance. Terms, conditions, limits, sub-limits, exclusions and eligibility criteria apply. See TSB Credit Mastercard Insurance Terms and Conditions for details.

The terms and conditions for the TSB Low Rate Mastercard and TSB Platinum Mastercard are set out in Credit Mastercard Conditions of Use, Credit Mastercard Fees Information and your card summary.

Mastercard and Priceless are registered trademarks, and the circles design is a trademark of Mastercard International.

Apple Pay, Apple Wallet, iPhone and Apple Watch are trademarks of Apple Inc., registered in the U.S. and other countries.

Google Pay is a trademark of Google LLC.