Make life easier with a simple everyday account that gives you full access to your money, however you like to bank.

At a glance

Key features

No account fee

With no account fees, you can manage your finances without the burden of extra costs.

Use ATMs nationwide¹

You'll pay no transaction fees to withdraw cash, check balances and make cash deposits (select machines only) at any TSB ATM, Allpoint ATM or bank branded ATM in NZ.

Easy access to your money

Use your Debit Mastercard to tap to pay using your digital wallet, or access your money using EFTPOS, ATMs, online banking, or the TSB mobile app.

Choose how you bank with us

Banking with us is easy, wherever you are. Manage your accounts online, on your mobile, in person, or with our phone banking2 service.

Only available for personal use

Exclusively designed for personal use, the Connect Plus account is the ideal choice for individuals who want to manage their everyday finances with ease.

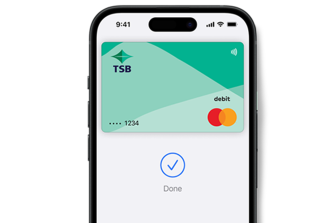

Connect your account to a

TSB Debit Mastercard

- No annual card fees

- Spend your own money

- Tap to pay with Apple Pay3 and Google Pay™4

- Use it online, in-store and overseas

- Protection from fraud with Mastercard's Zero Liability Promise5

Other fees apply. See TSB Debit Mastercard fees, limits and agreements for more detail.

Getting started

Already with us?

To open your new Connect Plus account, either log in to online banking and select ‘Apply’ on the left-hand menu, or give us a call on 0800 872 226.

Getting started

New to TSB?

Fill out our online form to open a Connect Plus everyday account and get set up with online banking.

Depositor Compensation Scheme

The Depositor Compensation Scheme (DCS) came into effect on 1 July 2025, providing additional protection for your deposits if a deposit taker goes out of business. Learn more about how it works and what it means for you here.

Important information

1. Use of any non New Zealand bank branded ATM may incur a service fee (in addition to any standard account transaction fee).

2. Phone Banking telephone access fee of $10 per user, per six-month period (first payment in advance, and six monthly thereafter), and payment establishment fee of $3 per authority applies.

3. The TSB Apple Pay Conditions of Use apply when you use your card in Apple Pay.

4. The TSB Google Pay Conditions of Use apply when you use your TSB Debit Mastercard in Google Pay.

5. For details on Mastercard’s Zero Liability promise visit mastercard.co.nz/zeroliability.

- TSB’s account opening criteria apply. Service fees may apply and are subject to change. See more about our account and service fees.

- When you bank with TSB you agree to our General Terms.