We know how important it is to feel confident your banking’s secure. That’s why we’re constantly improving the ways we protect you from fraud and scams.

Confirmation of Payee

The Confirmation of Payee service is a New Zealand banking industry initiative that aims to give you greater confidence when making payments. It’s available in online banking and the TSB mobile app.

When you use digital banking to set up a new payee, edit an existing payee or make a one-off payment, the ‘confirmation of payee’ feature lets you check that the account name and number match, to help you avoid sending money to the wrong person.

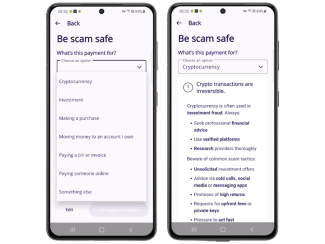

Payment purpose

As part of a banking industry commitment to fight scams and fraud, we've introduced a simple step to help protect you when making payments.

When you make a payment in-branch, over the phone, on the TSB mobile app or online banking, we may ask what it’s for and share some fraud warning messages based on your response. This is designed to help you pause, think and decide whether you want to continue with the payment.

Real time fraud detection

Our fraud detection system monitors debit and credit card transactions, as well as online and mobile payments, in real time. This allows us to quickly spot unusual activity and has already helped prevent TSB customers from hundreds of potential fraud attempts.

We use advanced security measures to protect your personal and banking information, but staying safe is a shared effort. If something doesn't look right, we'll get in touch with you so we can act quickly together.

Two factor authentication

Two-factor authentication provides an additional layer of security when using digital banking. It is provided via text message (a 4-digit code is sent via SMS to your registered NZ mobile number) or a TSB token (you need to be registered with a token and will be prompted to provide a 6-digit code).

A token is a small device from TSB that you can use for two-factor authentication in digital banking instead of receiving texts to your mobile. It's handy if you're travelling overseas or live in a location with limited mobile service.

Two-factor authentication is required when you:

- Make a payment over your set payment limit

- Update your mobile phone number

- Update your email address

- Add a new personal payee

- Increase the payment limit (after reducing it)

- Edit a payee

- Edit an upcoming or recurring payment

What TSB staff will never do

If we’re alerted to suspicious activity on your account, we’ll contact you – but we’ll never:

- Ask for your online banking or TSB mobile app login details.

- Ask for remote access to your device or to install software.

- Send text messages with links in them (no NZ bank does this).

If someone asks you to do any of these things, it’s likely a scam.

Hang up and call us directly on 0800 872 226.

Something not right?

We're here to help

If something doesn’t feel right, here’s what you can do:

Report it

Think something isn't right with your account?

- Stop all contact with the person you've been communicating with.

- Call us immediately on 0800 872 226 (or +64 6 968 3700 from overseas).

Lost or stolen card?

If you suspect fraud or your card has been lost or stolen:

- Temporarily block your card using card manager in online banking or the TSB mobile app.

- Contact us immediately on 0800 872 226, (or +64 6 968 3700 from overseas).

- Mastercard card holders can visit Mastercard Global Emergency Services for 24/7 international support.

Suspicious emails

Received a phishing or suspicious email that looks like it's from TSB?

- Don’t click any links or open attachments.

- Forward a copy or screenshot to us at report@tsb.co.nz