The perfect | amount of bank

Choose the home loan that's right for you

Whether you're looking to buy, build, switch or top up your home loan, we can help find the home loan solution that works best for you.

4.89 % p.a.

fixed for 1 year

View all rates

TSB's standard lending criteria, T&Cs, and fees apply. Min. 20% deposit.

Grow your savings with this great rate

Choose how long you want to put your money away for and your interest rate will be fixed until the end of the term, so you can grow your savings without any effort!

3.90 % p.a.

for 9 months

View all rates

Conditions apply. Min deposit $1k.

Be scam smart

Don't respond to unexpected text messages or click on unexpected links. If you are unsure if an email or text is legitimately from us, or notice unusual activity on your account, contact us on 0800 872 226.

Depositor Compensation Scheme

From 1 July 2025 the Depositor Compensation Scheme (DCS) comes into effect, providing additional protection for your deposits if a deposit taker goes out of business.

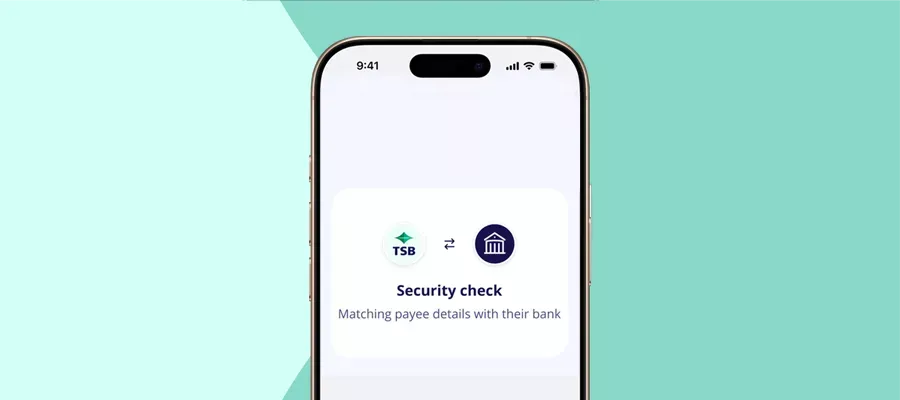

Confirmation of Payee

The Confirmation of Payee service is a New Zealand banking industry initiative that aims to give consumers greater confidence when making payments. It is available on TSB online banking and our app.

Get covered and save $100 with Tower today

You never know when ‘Miss Takes’ is going to show up, so make sure you’re covered with Tower and save $100 on every eligible house, landlord, and comprehensive car policy.* Ts&Cs apply.

Latest news

-

Fees & Rates

1 July 2025

Business, Rural and Commercial base rate changes - July 2025

Effective 1 July 2025, changes to our Business, Rural and Commercial base rate.

-

General

26 June 2025

TSB lifts profit and builds momentum for digital investment

The Bank delivered a net profit before tax of $57.6 million for the year ending 31 March 2025, up $6.7 million on the previous year.

-

General

6 June 2025

Cheers to 175 years - TSB celebrates its birthday with acts of kindness

TSB Bank is celebrating 175 years in business this month (5 June) by giving back to the communities that have invested in them.

Home loans

Whether you’re looking to buy, build, switch or top up your home loan, we can help find the home loan solution that works best for you.

Credit & Debit cards

Take a look at our Debit, Low Rate and Platinum Mastercard options and compare their key features to find the right card for you.

Invest

Watch your money grow. With great interest rates, term deposits and accessible investment accounts, you can decide how your money grows.

Accounts

Whether you're after a day-to-day spending account or looking to save for something special, we have a range of accounts you can choose from.

Business accounts

We're passionate about finding financial solutions that suit the needs of small to medium-sized businesses. And as an independent, New Zealand-owned bank, we're able to put the interests of our customers first.

Insurance

We partner with Tower for general insurance (house, contents, car, boat and landlord), and Chubb for life and living insurance, so you can make sure you’re protected for when the unexpected happens.

Commercial property

If you’re looking to purchase a commercial property for either owner-occupied or commercial investment purposes, our specialist Commercial Team can help you choose the right loan, depending on what you need and where you want to go.

Legal Documents and Information

Find key terms and conditions, policies and other important bank disclosure information.

Rates, Fees and Standard Contracts

Find our standard contracts for the key products we currently offer, including our consumer credit products, as well as the fees and interest rates that apply.

Home loans

Choose what's right for you. Whether you’re looking to buy, build, switch or top up your home loan, we can help find the home loan solution that works best for you.

4.89 % p.a.

fixed for 1 year

View all rates

4.95 % p.a.

fixed for 2 years

View all rates

6.39 % p.a.

variable rate

View all rates

TSB's standard lending criteria, T&Cs, and fees apply. Min. 20% deposit.

Term investments

Choose how long you want to put your money away for and your interest rate will be fixed until the end of the term, so you can grow your savings without any effort!

3.90 % p.a.

for 6 months

View all rates

3.90 % p.a.

for 9 months

View all rates

3.85 % p.a.

for 12 months

View all rates

Conditions apply. Min deposit $1k.

Low Rate and Platinum Mastercard

Choose between our lowest rate credit card, and our best card for cashback rewards.

Accounts

Whether you're after a day-to-day spending account or looking to save for something special, we have a range of accounts you can choose from.

Home loan borrowing calculator

Want to know how much you could borrow?

Simply enter a few details into the calculator below and we'll give you an estimate of how much you could borrow.

Currently under maintenance

Our home loan calculator is currently under maintenance. Please try again later, we apologise for any inconvenience.

Repayment calculator

Estimate your home loan repayments

Use our mortgage repayment calculator to work out what your repayments could be.

Currently under maintenance

Our home loan calculator is currently under maintenance. Please try again later, we apologise for any inconvenience.

Foreign exchange

Currency calculator

Get your money sorted before you head off so there's one less thing to think about when you pack.

Apply for a home loan

Apply online or chat to a lending specialist

You can start your application online today or send us an enquiry with your key details. One of our lending specialists will get in touch to chat through your home loan options.

Find the right card for you

Cards

Take a look at our Debit, Low Rate and Platinum Mastercard options.

Watch your money grow

Term investments

You can decide how your money grows.

Looking for a day-to-day or savings account?

Accounts

We have a range of accounts you can choose from.

How to guides

Looking for help?

Security tips

It’s important your money and personal information is kept secure.

Enquire about a home loan

Complete our enquiry form to arrange an email, phone or video call and we'll get in touch to chat through your loan options.

Financial assistance

If you're experiencing financial hardship, having difficulties with your repayments or think you might soon, get in touch to see how we can help.

Deceased estates

The last thing you want when a family member or friend has passed away is to worry about sorting out their financial affairs. We have a team dedicated to help you along the way.